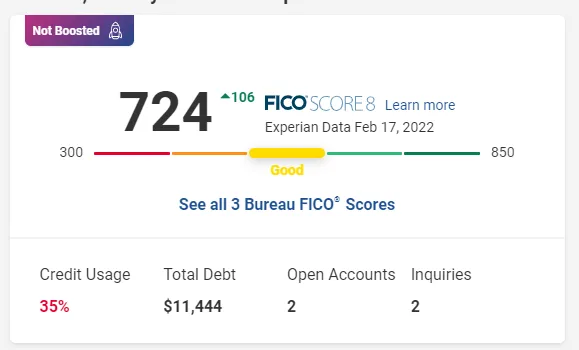

Are You Trying to Achieve a 700+ Credit Score?

Don't Know Where To Start?

TESTIMONIALS

Our Client Reviews

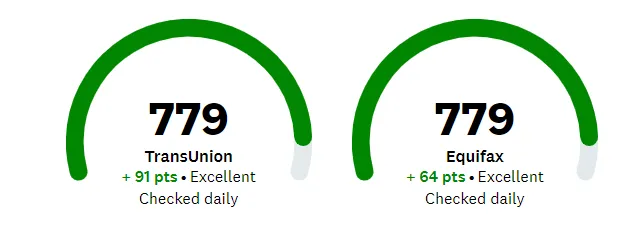

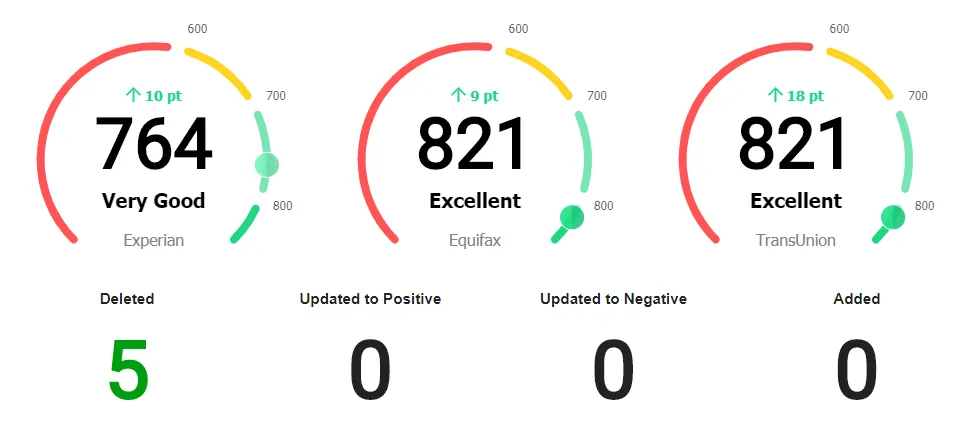

Tanner, a satisfied client, shares: 'TopWave transformed my financial life, not only increasing my credit card limits significantly but also aiding me in securing high limit personal and business cards.

Kelli, says : 'TopWave Financial was so impactful on my life that I just had to get on and say a few things. They were so, so wonderful. They talk you through every single thing. They take care of you completely.'

How Our Credit Refresh Process Works...

Review Credit Reports

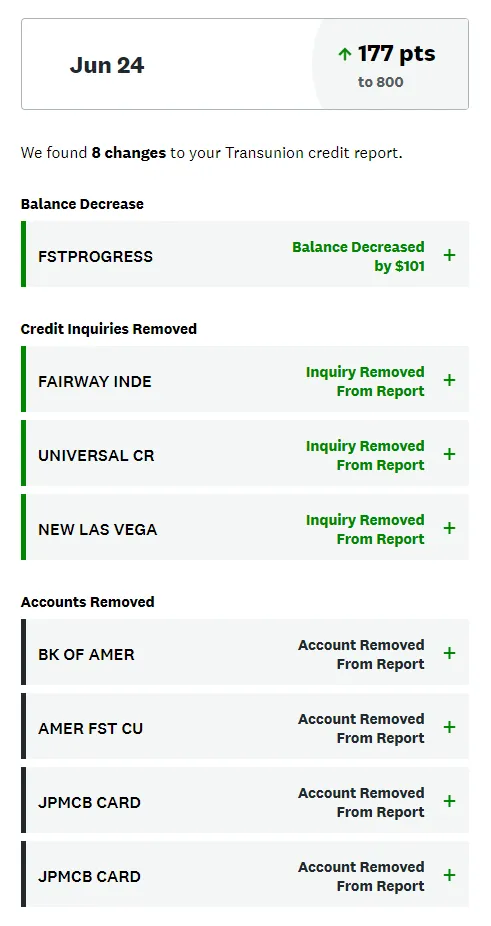

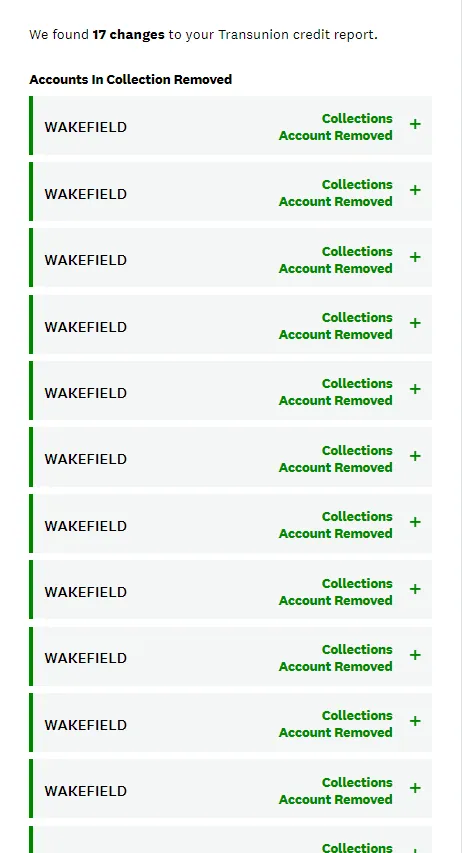

At TopWave, our initial approach involves a meticulous review of your credit reports from the three primary credit bureaus. We look for inconsistencies, old data, or unusual entries that may be impacting your credit standing.

After spotting these discrepancies, we formulate a strategy to address them. We guide you on how to communicate with credit bureaus and lenders, ensuring you're fully equipped to handle the process. You'll be informed of any potential changes to your credit report and score. At TopWave, our mission extends beyond improving credit standings - we're dedicated to fostering financial wellness and empowering you to reach your financial aspirations.

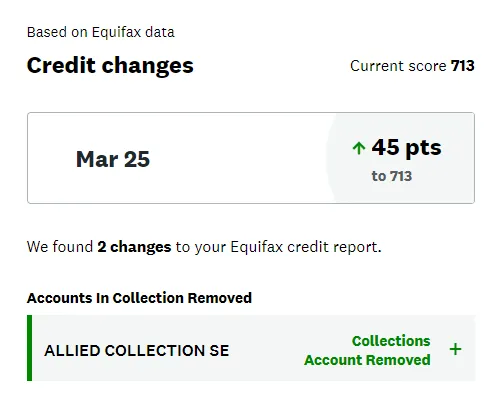

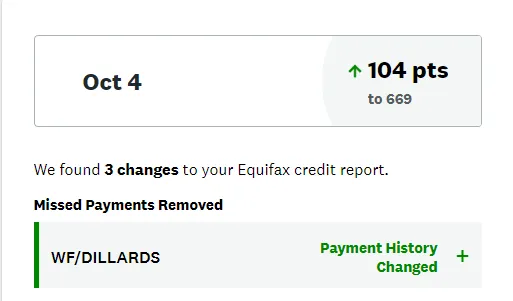

Fix or Dispute Errors

In the Credit Refresh Program, our focus is to help you identify inaccuracies on your credit report. Unnoticed misreported data or lingering past issues can negatively affect your credit score.

We guide you in initiating the dispute process by advising on crafting detailed letters to the credit bureaus, identifying each discrepancy. This involves a strategic communication approach with credit bureaus and creditors. By law, they are required to investigate these disputes and rectify any mistakes. We persistently guide you through the follow-up until the matter is addressed, aiming to clarify your credit report and aid in boosting your financial future.

LIFETIME Access

Once you join our program, you become a member for LIFE. What does this mean? Well basically we are going to work with you until all of the work is done. No matter how long it takes. We are going to hold your hand the entire way. Most credit consulting companies only focus on removing negatives from your credit reports. While we focus on BUILDING your reports simultaneously. We are so committed to changing your life that we do not stop helping you until you achieve your main goal, whether that be 'buy a house' , 'buy a car' , or even 'start a business'. We are partners with you until the job is finished. Credit is not the end all be all, it is simply the tool we use to achieve our LONG TERM GOAL.

Pay Down Outstanding

Another crucial aspect of our Credit Refresh Program involves guiding you in effectively managing and reducing your outstanding debt. It's not just about settling your bills punctually, but also strategically decreasing your overall debt burden. This action positively impacts your credit utilization ratio - a key determinant in credit score computations.

We provide insights and practical strategies on debt management, helping you prioritize high-interest debts and formulate a manageable plan to lessen them. This approach not only diminishes your credit utilization ratio but also boosts your standing with lenders, reinforcing your creditworthiness over time. Our goal is to provide you with a revitalized financial perspective, alleviating debt-related stress, and guiding you towards enhanced credit well-being.

Preparing for a Prosperous Future

At TopWave, we focus not only on managing the present but also on preparing you for the future. As part of our Credit Refresh Program, we introduce you to potential investment opportunities that align with your financial goals and risk tolerance.

We believe in personalized advice, considering your unique financial situation and comfort level with risk. Our aim is not just to improve your immediate financial health but to set the stage for long-term growth and prosperity. We're here to guide you towards financial freedom and a prosperous future.

Personalized Financial Consulting

At TopWave, we believe in a personalized approach to financial health. Each client has unique financial goals and circumstances, and our consulting services reflect that.

We work with you one-on-one to understand your specific situation, identify potential hurdles, and provide tailored advice. Our team helps with budgeting, debt management, and strategies for credit enhancement. We also guide you in exploring investment opportunities that align with your goals.

This hands-on, consultative approach empowers you to take charge of your financial future and make informed decisions. With TopWave, you're not just improving your financial health; you're gaining the tools and knowledge to maintain it.

ABOUT US

Elevate, Empower & Strengthen Your Financial Health!

At TopWave, our mission expands beyond credit matters – we're determined to drive a transformation that echoes across every dimension of your financial life. Our commitment lies in strengthening your financial resilience, empowering you with knowledge, and assisting you in building a robust financial foundation.

We're a team ignited by the profound satisfaction of seeing our clients attain financial freedom. To us, there's no greater reward than guiding you in bolstering your financial health, unlocking opportunities once thought inaccessible. We believe everyone deserves a shot at a prosperous financial future, and hence we've crafted our exclusive Financial Wellness Program.

Our passion extends beyond traditional financial metrics. We're about disseminating financial education, fostering healthier habits, and instilling a sense of financial self-reliance. Our goal is to help you regain control, overcome obstacles, and chart a course towards a brighter financial horizon. Join us on this journey towards financial empowerment and prosperity, because at TopWave, your success is our triumph!

Financial Life Consulting

Unlock your financial future – click to begin your credit refresh journey!

WHY CHOOSE US

Benefits of Better Credit Score and Restoration

Approval for Higher Limits

Boosted credit scores pave the way to amplified credit limits. A restored credit profile means you're trusted by lenders to handle more substantial borrowing responsibly.

Qualify for Better Options

A revitalized credit score unlocks doors to superior financial alternatives. With higher credit, you gain access to more favorable lending terms and conditions. This will open the door to investment opportunities so we can begin to grow your wealth.

More Negotiating Power

With an improved credit profile, you'll find yourself in a position of strength when negotiating terms with lenders, potentially securing lower interest rates and better loan conditions. Can even secure lines of credit with little to no interest in order to start a business! Which is the end goal.